The dispute at the heart of the United States underway government closure Focus on a tax credit that helps 22 million Americans reduce their health insurance costs when they buy policies via the markets of the affordable care law.

Known by the name of tax credit for the improved premium, the subsidy has been used by millions of low and average class households since its authorization under the American Rescue Plan ACT in 2021. Since then, stimulated by the tax credit, the number of people who have registered in the ACA Marketplace health insurance plans have almost doubled, according to the publication of KFF health care.

But it should expire at the end of 2025, and the main Democratic legislators concluded a financing agreement to keep the government open to the Republicans who agree to extend the credit. A new October 3 survey of the KFF health information group has revealed that three -quarters of those questioned say they want the Congress to grant tax credits, with around 59% of Republicans saying that they would like to see an extension.

Even if the outcome of financing negotiations in Washington, DC, remains uncertain, the expiration of premium health care credits could inflict millions of Americans, experts at CBS News said.

“Insurers are already preparing to send opinions to households according to which they will see increases from January 2026,” said Alex Jacquez, head of the collaborative Groundwork policy, a defense group for liberal economic defenders and former economic official of the White House under former president Joe Biden, during a conference call on Friday to discuss the tax credit.

He added: “People are increasingly concerned about the cost of living, and (it is) a success to their wallets that they have been starting to see for weeks.”

The White House did not respond to a request for comments.

Here is what you need to know about the Impa Impaled ACA Tax Tax credits that would expire at the end of 2025.

How much could the ACA bonuses increase?

The cost of premiums for people who buy their insurance via the ACA markets could more than double, going on an average of $ 888 in $ 2025 to $ 1,904 in 2026, according to an analysis of September 30 by KFF. About 4 million people would probably abandon their insurance coverage if the credit is authorized to expire because they could not afford the fees, said the Congressional Budget Office.

The premium tax credit is aimed at people who gain too much to qualify for Medicaid, the health insurance program for low -income Americans and who cannot obtain affordable health care through an employer. Credit is available for those who earn between 100% and 400% of the poverty level, which means that a family of four with an annual income of up to $ 128,600 would be eligible for credit.

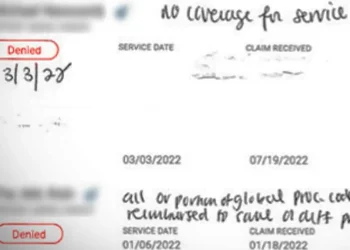

With the expiration of ACA’s coverage credit only months, some policies have already received that their premiums – the monthly costs paid for insurance coverage – are ready to increase next year. Insurers have sent opinions in almost all states, some offering bonus increases up to 50%.

Insurers are already planning increases in substantial bonuses in 2026, according to a survey on trackers of the Peterson KFF health system published last month. The survey revealed that 312 insurers participating in the ACA markets offer median increases of 18% next year, or around 11 percentage points higher than in 2025.

This increase would represent the increase in the largest rates since 2018 and has been driven by higher costs for medical care as well as the expiration of premium tax credits. ACA bonuses, much higher would probably lead to a lower health, which makes you more expensive to ensure those who stay, said the group.

The increases proposed range from 39.9%, from Blue Cross Blue Shield of Oklahoma, at least 4.6% for Oscar Garden State Insurance Corporation, according to their survey.

In Iowa, last month, the state insurance commissioner weighed increases ranging from 3% to 37%, arousing public concerns. A woman who runs a garden center at Cedar Falls, Iowa, said she was considering dropping health insurance completely.

“I already live as frugally as possible while working as hard as possible, spending as many hours as I am authorized at my work, without ever missing a working day,” wrote a woman, Luann, in a commentary published on the Commissioner’s website.

Signs of financial fragility

The potential increase in insurance costs occurs because many Americans continue to struggle with the cost of living, said Rohit Chopra, former director of the Consumer Financial Protection Office, during the Conference Log with Jacquez, organized by Groundwork, which supports the extension of credits.

“Some people will have to abandon their insurance, but households with a person with chronic disease will have to pay for these major increases,” said Chopra. This would force some families to make difficult financial choices, such as not paying other bills or accumulating debt to cover their expenses, he added.

Although inflation in the United States has considerably attenuated since its post-payic peck in 2022, costs continue more. The inflation objective of 2% of the federal reserve is further from the scope this year, the consumer price index climbing higher In recent months. Some consumers show signs of increasing financial stress, with increased credit card delinquenous and balances crawling above.

Meanwhile, many Americans do not know that tax credits for the premiums improved by ACA will expire in a few months, KFF noted in an investigation.

“Consumers should not panic, but they have to prepare,” said Louise Norris, analyst of health policies on the healthcinterance.org insurance website, in an email.

People must ensure that they compare various plans available to them on the markets and to explore options such as health savings plans, which allows people to reserve money to pay for medical spending, she said.

“Being proactive will help minimize financial surprises,” said Norris.

contributed to this report.