Sofi Technologies (SOFI) and Robinhood Markets (Hood) are two of the most popular American fintech platforms in competition for the attention of investors. The two actions rebounded in 2025, supported by better profitability and a renewal of the interests of retail merchants. But as competition is heating up, what stock offers the most increase in long -term investors? Let’s decompose it.

Raise your investment strategy:

- Take advantage of Premium Tipranks at 55% reduction! Unlock powerful investment tools, advanced data and expert analyst information to help you invest with confidence.

Sofi’s full service in full service or Robinhood’s investment

Sofi works as an all-in-one digital bank, offering a wide range of financial services under a single platform. Robinhood, on the other hand, specializes in a simple and mobile investment experience that allows users to exchange actions, options and cryptocurrencies.

Until now, in 2025, the Robinhood rally has been much stronger, fueled by the increase in negotiation volumes and the enlargement of sources of income. In particular, the hood stock jumped almost 300%, losing its image of stock of the same to become one of the best fintech artists of the year.

Meanwhile, Sofi shares have increased by around 64% since the start of the year, supported by the growth of its digital banking activity and solid financial results.

Is Sofi a good purchase right now?

In the second quarter of 2025, Sofi posted strong growth, with net adjusted income climbing 44% in annual sliding and an EBITDA adjusted up 81% compared to last year. The company also added a record of 850,000 new members, bringing a total number of members to 11.7 million.

The growth of the company is largely motivated by its technology, which offers a simple and friendly experience which distinguishes it from traditional banks, while continuous innovation with new products helps to attract and retain customers. This year, SOFI plans to relaunch the trading of cryptocurrencies and is associated with the Lightspark payment company to provide low-cost international money transfers using the Bitcoin network.

For the future, investors remain optimistic, with rapid growth, a growing member of members, an expansion of product offers and an emphasis on costs based on costs. However, Wall Street analysts are divided, consensus suggesting prudence and a risk of withdrawal from current levels.

Is Hood a good stock to buy now?

At the end of the second quarter, Robinhood had 26.5 million customers and generated $ 989 million in income, marking a 45% increase in the next. In particular, negotiation revenues for cryptocurrencies jumped 98% in annual shift, compared to T2 2024.

While Robinhood continues to attract new customers, most of its growth is now coming from a stronger commitment among existing users. In the second quarter, average revenues per user increased by 34%, most of the benefits drawn by higher account sales rather than new registrations. The company also extends its scope by introducing new products and services that resonate with its main audience, opening a wider market opportunity.

For investors, the history of Robinhood evolves beyond its retail roots, creating a stronger and more stable business by serving all types of customers, even if market oscillations continue to have an impact on short-term results.

Risks of evaluation

Despite an optimistic perspective, evaluation remains a key consideration for SOFI and Hood actions. The hood is negotiated at a high P / E of around 75, while the P / E of Sofi is 50.9, compared to the sector average of 13.25.

Many actions are currently expensive due to the current level market, but high assessments have little room for error. If these companies are faced with one or two weak quarters, their equity prices could fall strongly as investors switch to cheaper alternatives.

However, in the long term, what really matters is the growth of a business, and these two companies thrive in this area.

Hood or Sofi: What action offers a higher increase, according to analysts?

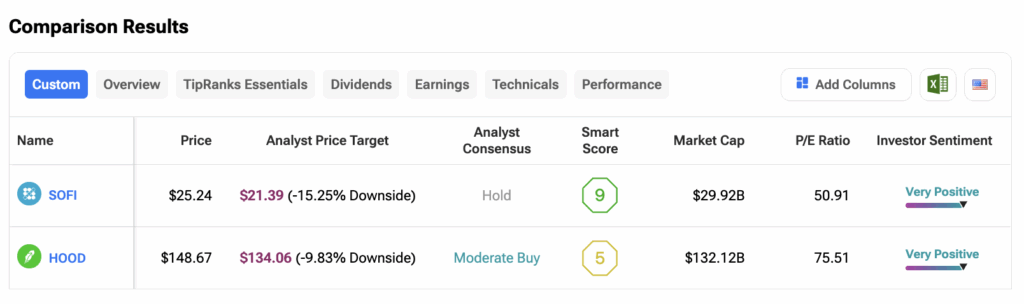

Using the Tipranks stocks comparison tool, we compared Hood and Sofi to see which Fintech stock market analysts favor. Hood obtains a moderate purchase rating of analysts, while SOFI has a support rating. The two actions have recently increased and analysts see a short -term limited increase. The average objective of the SOFI stock market course of $ 21.90 suggests around 14% decrease. Robinhood has a price target of $ 134.06, which implies a downside of 10%.

Conclusion

In conclusion, Sofi and Robinhood have a strong growth potential, but distinctly. Sofi stands out from its expansion digital banking banking platform and its regular growth in profits, while Robinhood capitalizes on its main trading platform and its new financial products to attract more investors. The choice comes back to know if you prefer banking stability or growth -oriented growth.

Warning and disclosure