In the largest Medicare Advantage fraud settlement to date, Kaiser Permanente agreed to pay $556 million to settle Justice Department allegations that it billed the government for health problems patients did not have.

The settlement, announced Jan. 14, ends lawsuits from whistleblowers who accused the health insurance giant of running a years-long scheme in which it overestimated patients’ levels of illness in order to illegally increase its revenue.

“Medicare Advantage is a vital program that must serve the needs of patients, not corporate profits,” said U.S. Attorney Craig Missakian of the Northern District of California, announcing the settlement.

“Medicare fraud costs the public billions each year. So when a health plan knowingly submits false information to obtain higher payments, everyone – from beneficiaries to taxpayers – loses,” he said.

Medicare Advantage plans offer seniors a private alternative to Original Medicare. Insurance plans have grown significantly in recent years and now have about 34 million members, or more than half of those eligible for Medicare. About 2 million Medicare members are enrolled in KP plans.

Attorney Max Voldman, who represents whistleblower James Taylor, said the case shows the need for a “continued effort to combat health care fraud.”

“It’s important to send a signal to the industry, and we hope this figure achieves that,” he said.

Taylor, a longtime Kaiser Permanente physician, filed a lawsuit against the company in October 2014.

“It was a long, hard-fought case,” Voldman said.

The Justice Department took up its case, along with others, in July 2021. In court filings, the government argued that the health plan “pressured” doctors in Colorado and California to add diagnoses “regardless of whether these conditions were actually considered or addressed by the physician during patient visits,” policies that violated Medicare requirements.

From 2009 to 2018, KP added approximately half a million diagnoses that generated approximately $1 billion in improper payments to the health plan, according to the complaint.

The government pays Medicare Advantage plans higher rates to cover sicker patients. But over the past decade, dozens of lawsuits, government audits and other investigations have alleged that health plans exaggerate patients’ health status to pocket payments they don’t deserve, a tactic known in the industry as “upcoding.”

The Justice Department alleged that Kaiser Permanente officials knew its practices were “widespread and illegal” but that the company “ignored numerous internal red flags and warnings that it was violating” Medicare rules. In settling the case, KP admitted no wrongdoing.

In a statement on its website, the company said it settled the case “to avoid the delays, uncertainty and cost of protracted litigation.”

The company noted that other health plans have “been subject to similar government scrutiny” regarding Medicare Advantage billing practices. He said the whistleblower cases “involve a dispute over how to interpret” Medicare billing requirements.

The civil lawsuits were filed under the False Claims Act, a federal law that allows private citizens to sue on behalf of the government and share in any money collected.

In total, six whistleblowers filed complaints against Kaiser Permanente. In June 2021, the District Court for the Northern District of California consolidated the cases into two, one brought by Taylor and the other by Ronda Osinek, also a former KP employee.

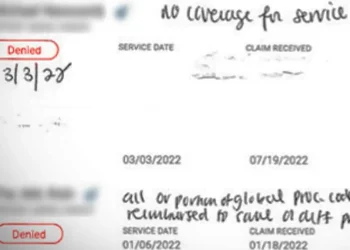

Osinek, who trained doctors in medical coding guidelines, filed her case in August 2013. In her complaint, she alleged that Kaiser Permanente inflated claims submitted to Medicare by asking doctors to change medical records, often months after a patient’s visit, to apply diagnoses that were not being addressed at the time or did not exist.

As part of the settlement, whistleblowers, called “relators,” are expected to receive a total of $95 million, according to the Justice Department.

The KP settlement follows a Senate report this month accusing UnitedHealth Group of “gaming” with the Medicare Advantage payment system, known as “risk adjustment.”

“My investigation showed that UnitedHealth Group appears to be gaming the system and abusing the risk adjustment process to generate large profits,” Sen. Chuck Grassley (R-Iowa) said in a statement accompanying the report’s release.

Grassley, who chairs the Senate Judiciary Committee, said his findings were based on a review of more than 50,000 pages of internal company documents. UnitedHealth Group disputed the findings and has long denied that its coding practice triggers improper payments.

The report cites several health issues that have repeatedly been linked to overbilling by Medicare Advantage plans, such as the coding of opioid dependence disorder in patients who take their medications as directed for pain relief.

The Senate report also alleges that Medicare Advantage plans misdiagnosed dementia.

The report said Medicare removed dementia from its list of codes in 2014, in part because of concerns about the upgrade. After the Centers for Medicare & Medicaid Services reintroduced the code in 2020, researchers found that “annual dementia diagnosis rates in MA increased by 11.5%” compared to traditional Medicare, the report said.

“Medicare Advantage is an important option for older Americans, but as the program adds more patients and spends billions of taxpayer dollars, Congress has a responsibility to conduct aggressive oversight,” Grassley said. “Excessive federal spending on UnitedHealth Group not only hurts the Medicare Advantage program, it hurts the American taxpayer.”

Source | domain kffhealthnews.org