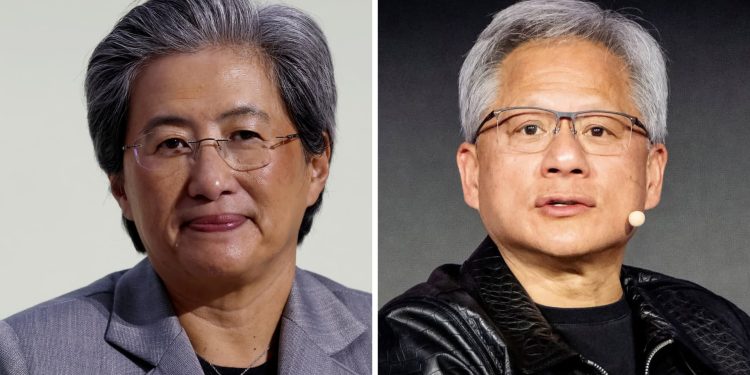

AMD CEO Lisa Su, left, and Nvidia CEO Jensen Huang

Benoît Tessier | Ritzau Scanpix | Mads Claus Rasmussen | Reuters

In the 1990s, when Intel dominated the PC chip market, the semiconductor maker needed Advanced microdevices exist as a viable number 2 to avoid being accused of monopolistic behavior.

Nearly three decades later, AMD could play a similar role for Nvidiawhich controls more than 90% of the market for graphics processing units used for artificial intelligence workloads.

When AMD announced a deal Monday involving the sale of multibillion-dollar GPUs to OpenAI, it presented itself as a serious rival capable of capturing share in the fast-growing AI chip market, analysts said.

“Right now, Nvidia has almost a monopoly, with AMD having a single-digit share in the $250 billion market” for AI data center silicon, said Mandeep Singh, principal analyst at Bloomberg Intelligence.

So far, Nvidia and OpenAI have defined the new era of AI.

Nvidia’s GPU sales have pushed the company’s market cap to $4.5 trillion. OpenAI’s private market valuation has soared to $500 billion, thanks to the popularity of ChatGPT and the company’s hyper-aggressive plans to build data centers.

Nvidia is a significant investor in OpenAI and last month agreed to invest up to $100 billion in developing the AI startup’s infrastructure.

Although AMD is a very distant challenger, the stock is also a Wall Street darling because of the company’s AI promises and the hope that its GPUs will be eagerly snapped up by customers. But until its announcement with OpenAI this week, AMD’s rally was largely based on hope.

AMD stock soared 24% on Monday, its biggest gain since 2002. It is up 89% this year, compared with 40% for Nvidia.

Nvidia’s control over this booming market is so vast that in September of last year, during the waning days of the Biden administration, the company was reportedly subpoenaed by the Justice Department, although it denied this. Sen. Elizabeth Warren, Democrat of Mass., then sent a letter to the DOJ’s antitrust unit supporting an investigation.

The company’s growth, she writes, “was driven by Nvidia’s use of anticompetitive tactics that stifled competition and chilled innovation.” Nvidia said at the time that it won on merit.

The deal that OpenAI and AMD announced on Monday could change competitive dynamics.

The tie-up is expected to generate revenues of “double-digit billions” for AMD starting in the second half of next year. OpenAI could also end up owning 10% of AMD if the stock hits its price targets over a multi-year period.

On a call with reporters, AMD CEO Lisa Su called the deal a “win-win” and said it was proof that her company’s chips are fast and affordable enough to compete with Nvidia’s.

She described OpenAI’s commitment as a “clear signal” that AMD’s GPUs and software deliver the performance and economic value “required for the most demanding large-scale deployments.”

Nvidia CEO Jensen Huang said on CNBC’s Squawk Box on Wednesday that the OpenAI-AMD deal was “unique and surprising.”

“I’m surprised they’re giving away 10 percent of the company before they even build it,” Huang said.

“That’s smart, I guess,” Huang said.

The deal also allows OpenAI to show that its contracts and investments with vendors like Nvidia are not exclusive, to avoid any potential antitrust ramifications. OpenAI CEO Sam Altman said on social media that all AMD chips would be “incremental” compared to its purchases from Nvidia and that “the world needs a lot more compute.”

“None of these things, to my knowledge, constitute an exclusive contract that opens the way for other competitors,” said Alden Abbott, a senior fellow at the Mercatus Center and former general counsel for the Federal Trade Commission. “I don’t see any argument that, in the short term, would demonstrate monopolization or cartelization of AI providers.”

Representatives for Nvidia, AMD and OpenAI declined to comment.

“Committed to building”

When it comes to Washington, D.C., regulators aren’t the only concern. Those pressures have apparently lessened this year under the Trump administration’s DOJ mandate.

Semiconductor investors are instead worried about potential tariffs, particularly Section 232 tariffs focused on chips. President Donald Trump said the tariffs, which have not yet taken effect, would double the price of imported chips. But in August, the president introduced a significant exclusion.

“If you’re building in the United States or you’re committed to building — definitely committed to building in the United States — there will be no charge,” Trump said at an event to announce. Apple investments. The Trump administration’s AI Action Plan pushes the United States to export “full-stack” AI technology abroad so that it can become the global standard.

Ed Mills, a policy analyst at Raymond James in Washington, said it’s not entirely clear what would benefit from the exemption, adding that OpenAI’s investment in AMD could end up being an “off ramp” for the company.

Nvidia and OpenAI have already played an important role in Trump’s AI ambitions, joining Oracle in January, when the president announced Project Stargate, a plan to invest up to $500 billion in America’s AI infrastructure.

CEO Dr. Lisa Su, AMD executives and industry luminaries reveal AMD’s vision for Advancing Al.

Courtesy: AMD

As part of the AMD deal, OpenAI will use the company’s Instinct MI450 systems, which will begin shipping next year. This is the first time AMD has offered a “rack-scale” system, not just individual chips, and it means AMD is the only company besides Nvidia to offer a full stack of AI hardware technologies.

“By having as much OpenAI buy as AMD, we now have a multiplayer race that seems to be sort of dominated by Nvidia,” Mills said. “So we are increasing the number of American companies that will be able to compete in producing this American technology stack.”

There is also the problem of China.

Nvidia and AMD both offer China-specific AI products that the U.S. government has banned from shipping to the world’s second-largest economy, which is a major center for AI research. The Trump administration reversed course over the summer and said companies could export chips if they paid the U.S. government 15% of revenues, but they still needed export licenses.

Trump is expected to meet with Chinese President Xi Jinping at the Asia-Pacific Economic Cooperation forum later this month. Recent reports suggest China could commit to investing $1 trillion in the United States, and Mills said high-priced AI chips could be part of the deal.

AMD has consistently downplayed competition with Nvidia, instead emphasizing the potential AI opportunity. The company recently said the AI chip market could be worth $500 billion by 2028, and said this week that the OpenAI deal was worth at least “tens of billions of dollars in revenue.”

“I think they can get to 15 to 20 percent market share in a $500 billion market, where before they had no chance,” Bloomberg’s Singh said.

The Trump administration may not be that concerned about antitrust issues, but Nvidia and AMD are in the early stages of a battle that is expected to play out over many years, and it’s unclear who will be in the White House after Trump’s second term ends.

Antitrust regulators have paid close attention to the market in the past. The last time AMD played second fiddle in chips, it was Intel that was the industry giant.

The FTC opened an investigation into Intel in 1991, looking into possible anticompetitive practices in the PC market, and AMD filed a $2 billion antitrust suit against the company that year. The FTC never filed a complaint, and AMD and Intel ultimately settled their case.

Today, AMD is worth about twice as much as Intel. And, after a series of transactions, Intel’s largest shareholder is the US government, followed closely by Nvidia.

WATCH: The wave of OpenAI transactions