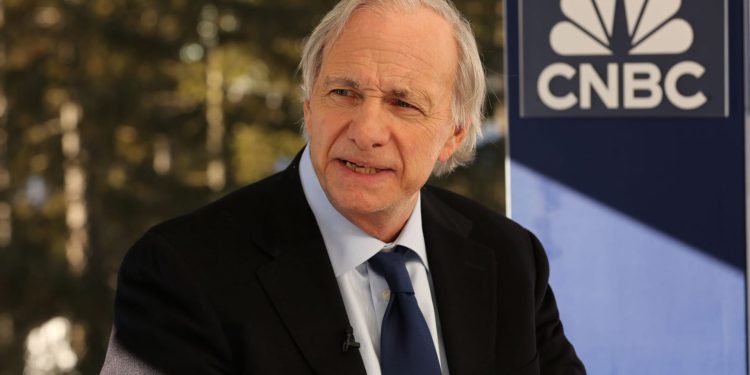

Ray Dalio of Bridgewater Associates on stage at CNBC’s Converge Live in March.

Courtesy of CNBC

Bridgewater Associates founder Ray Dalio said investors should allocate up to 15% of their portfolios to gold, as the precious metal reached a level above $4,000 per ounce.

“Gold is a very excellent diversifier in the portfolio,” Dalio said Tuesday at the Greenwich Economic Forum in Greenwich, Connecticut. “If you look at it just from a strategic asset allocation perspective, you would probably have something like 15% of your portfolio in gold… because it’s an asset that does very well when typical parts of the portfolio decline.”

Gold Futures Year to Date

Gold futures last traded at $4,005.80 an ounce. Prices have skyrocketed more than 50% this year amid a flight to safety amid budget deficits and growing global tensions.

The billionaire investor compared today’s environment to the early 1970s, when inflation, heavy government spending and high debt burdens eroded confidence in paper assets and fiat currencies.

“It’s a lot like the early 70s… where do you put your money?” He said. “When you hold money and put it into a debt instrument, and when there is such a supply of debt instruments and debt, it is not an effective store of wealth.”

Dalio’s recommendation contrasts with typical portfolio recommendations from financial advisors who tell clients to hold primarily stocks and bonds in a 60-40 split. Alternative assets like gold and other commodities are typically suggested as a low single-digit percentage of any portfolio due to the lack of income they generate.

Doubleline Capital CEO Jeffrey Gundlach also recently recommended a high gold weighting – up to 25% in the portfolio – as he believes gold will continue to outperform inflationary pressures and a weaker dollar.

Dalio said Gold stands out as a hedge in times of monetary damage and geopolitical uncertainty.

“Gold is the only asset that someone can hold and you don’t have to depend on anyone else to pay for your money,” he said.