The IA company on the back of Microsoft (MSFT) Openai quickly became one of the most influential companies on the stock market despite a private company, according to Bloomberg. Indeed, last week, the company launched a “buy” button inside Chatgpt which caused electronic trade actions like Shopify (Shop) and Etsy (Etsy) to jump. Then, he shared a blog article on internal tools that can help research, customer support, contract research and personalized sales responses, which led to a drop in software stocks like Atlassian (team).

Raise your investment strategy:

- Take advantage of Premium Tipranks at 55% reduction! Unlock powerful investment tools, advanced data and expert analyst information to help you invest with confidence.

It should be noted that it is unusual for a private startup, even a value of $ 500 billion, to have so much marketing power. But investors are now looking at Openai announcements as closely as they would do it news from Apple (AAPP) or Nvidia (NVDA). This is why the annual DevDay of Openai conference, held in San Francisco, attracts attention so much. Investors expect updates to new AI tools, such as a smarter travel booking assistant or a web browser powered by AI. If Openai is entering new areas, this could stimulate its infrastructure partners or providers, but already injured businesses on these markets.

In addition, the five-star analyst UBS (UBS), Karl Keirstead, noted that with the high cost of the execution of Chatgpt, Openai should try to grow beyond subscriptions. This is why traders are impatient to obtain indices on what will follow – especially since any new functionality could disrupt entire industries or give investors a new action on which to bet. With more than 700 million chatgpt users, $ 4.3 billion in income in the first half of 2025 and a loss of 2.5 billion dollars, Openai moves quickly and takes risks.

Is MSFT Stock a purchase?

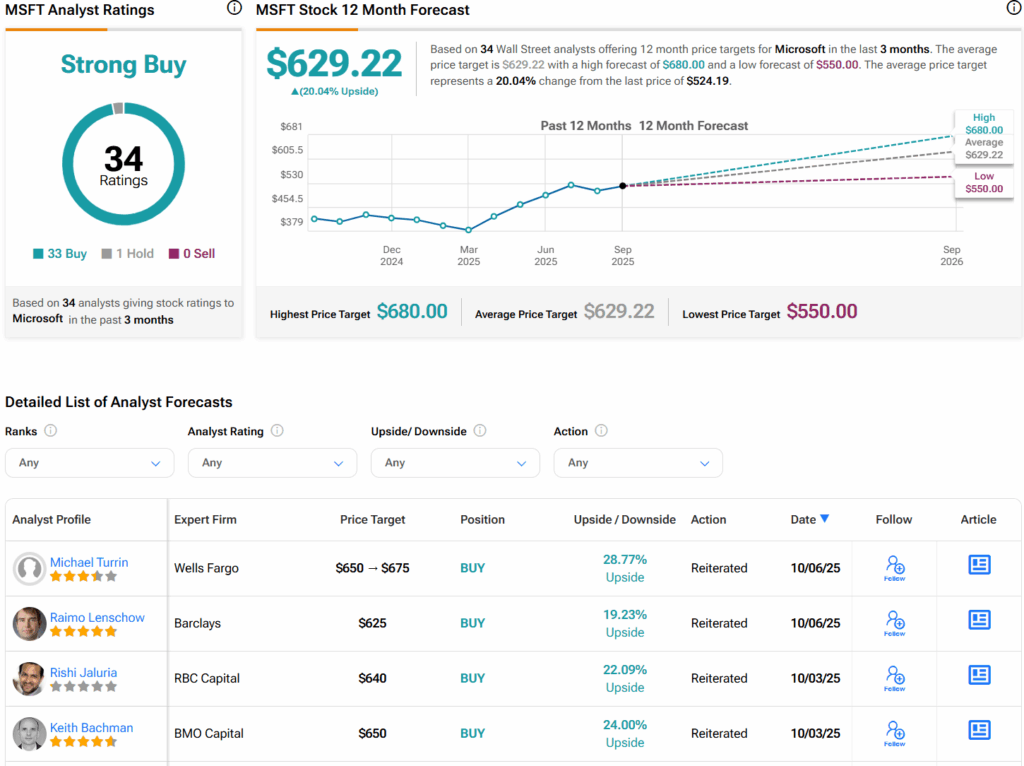

Turning to Wall Street, analysts have a high purchase consensus rating on MSFT shares on the basis of 33 purchases and an output awarded in the last three months. In addition, the average MSFT price target of $ 629.22 per share implies an increase in 20%.

See more MSFT analyst notes

Warning and disclosure